Tips for Answering SQE1 Practice Questions MCQs

Share

SQE1 makes use of single best answer MCQs (Multiple-Choice Questions) to test your functioning legal knowledge across various practice areas and assess your ability to apply legal principles in practical contexts. Success in these questions requires more than just memorising legal rules as it requires careful reading, logical reasoning, and strategic preparation.

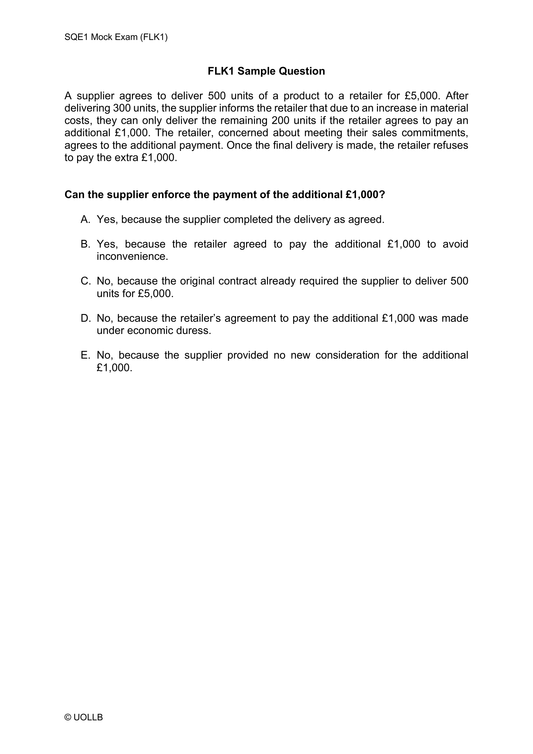

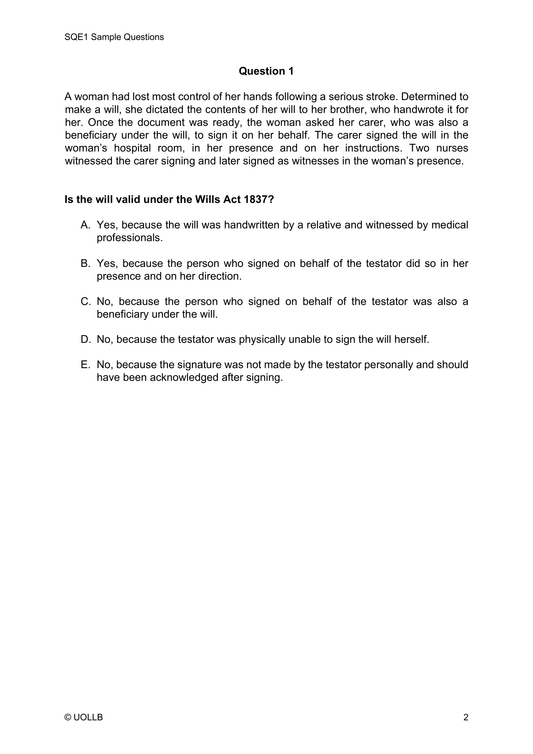

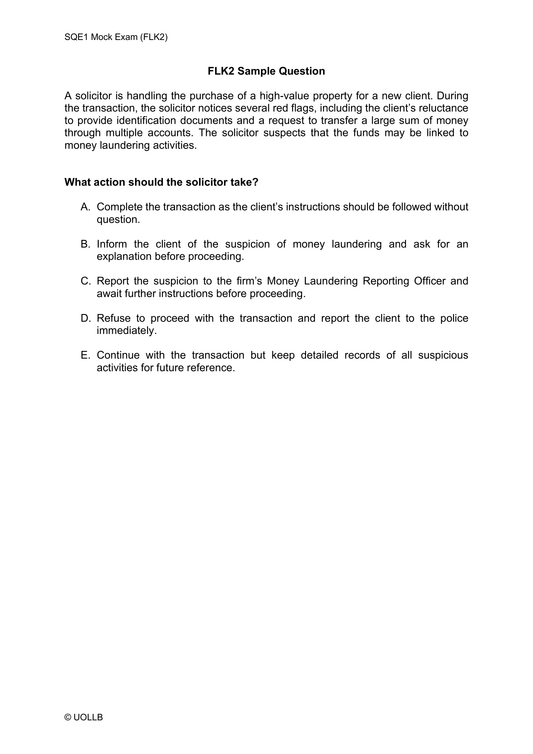

To approach MCQs effectively, it is essential to understand their structure. Each question begins with a scenario that sets out a problem or legal issue, followed by a specific question and five possible answers. While some options may seem plausible, only one is the best and most legally accurate response. The challenge lies in distinguishing between options that might be superficially correct and the one that directly addresses the question posed.

Reading the question carefully is the first and most crucial step. Candidates often make mistakes by skimming the text and missing key details. Each scenario contains critical information, such as timelines, jurisdictions, or the specific actions of the parties involved, which must be understood to identify the correct answer. A thorough reading ensures that you comprehend the facts and the legal issue being tested, minimising the risk of overlooking important matters.

Breaking down the scenario into manageable parts is equally important. Start by identifying the key facts and the legal issue at hand. Determine which area of law is relevant and consider the specific principles or rules that apply. For example, in a question about negligence, you would need to analyse whether all elements, namely duty of care, breach, causation, and damages, are present. This methodical approach allows you to focus on the core issue without being distracted by extraneous information.

Once you understand the question and its context, consider all five answer options carefully. Even if an answer seems correct at first glance, it is important to evaluate all options before making a choice. This ensures you do not miss a better, more precise answer. Eliminate options that are clearly irrelevant, inconsistent with the facts, or incorrect based on your knowledge of the law. Narrowing down the choices makes it easier to identify the single best answer.

Applying legal principles logically is a must for answering MCQs. These questions test your ability to reason through legal problems, not just your ability to recall rules. Think about how the law applies to the facts presented and ensure your answer reflects both the specific legal issue and the scenario’s details. For example, if the question concerns a breach of contract, consider whether all elements of contract formation, breach, and remedies are addressed by the option you choose.

Time management is another critical aspect of success in MCQs. With 180 questions to answer in two sittings, you have approximately 1 minute and 42 seconds per question. While it is important to read and analyse each question carefully, you must avoid spending too much time on a single question. If you are unsure about an answer, eliminate as many incorrect options as possible, make an educated guess, and move on. Mark the question for review if the system allows, so you can revisit it later if time permits.

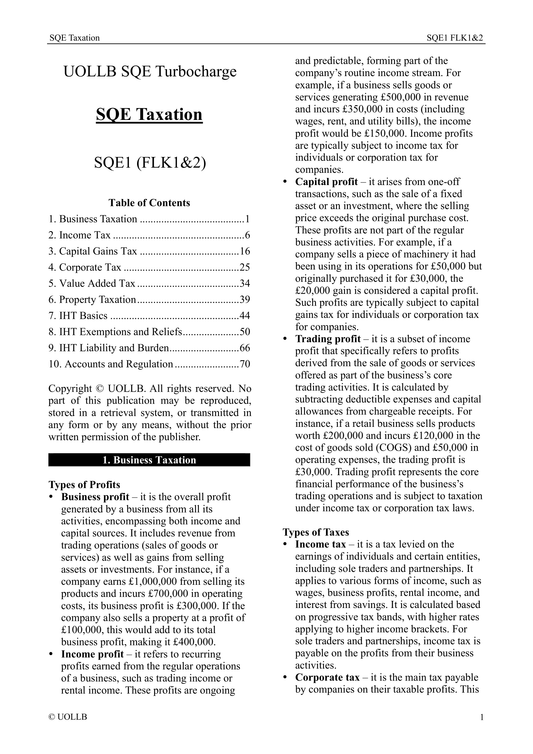

Consistent practice is essential to mastering the single best answer format. Mock exams and practice questions, such as our SQE1 Practice Tests, help you become familiar with the style and complexity of the questions. They also allow you to refine your exam techniques, such as identifying key facts quickly and managing your time effectively. Reviewing the reasoning behind correct and incorrect answers helps you understand common pitfalls and improve your problem-solving approach.

Finally, staying calm and focused during the exam is crucial. The sheer volume of questions and the pressure to perform can be overwhelming, but maintaining a clear and confident mindset will help you make better decisions. If you encounter a particularly difficult question, remind yourself that every question carries the same weight. Move on and return to it later if necessary. Trust your preparation and your ability to analyse the problem logically.