SQE1 Overview

Share

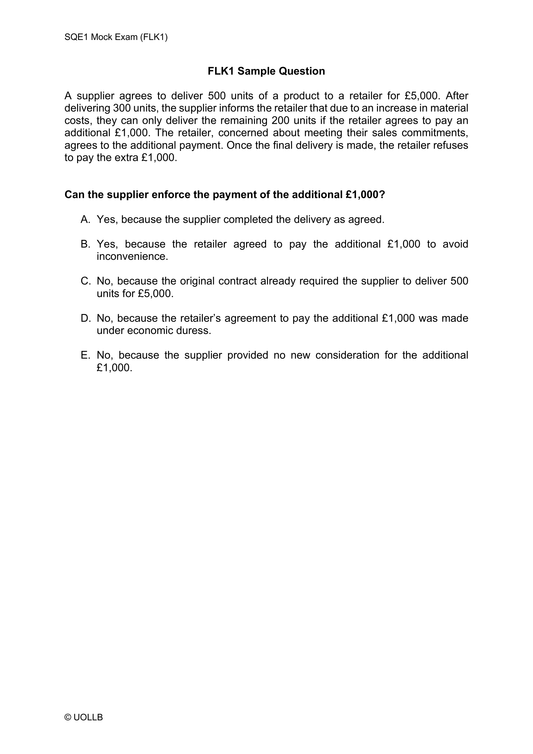

The SQE1 assessments consist of two Functioning Legal Knowledge (FLK) exams, each designed to test a range of legal subject areas relevant to the practice of law. Each of these assessments incorporates questions that may involve any combination of these subject areas.

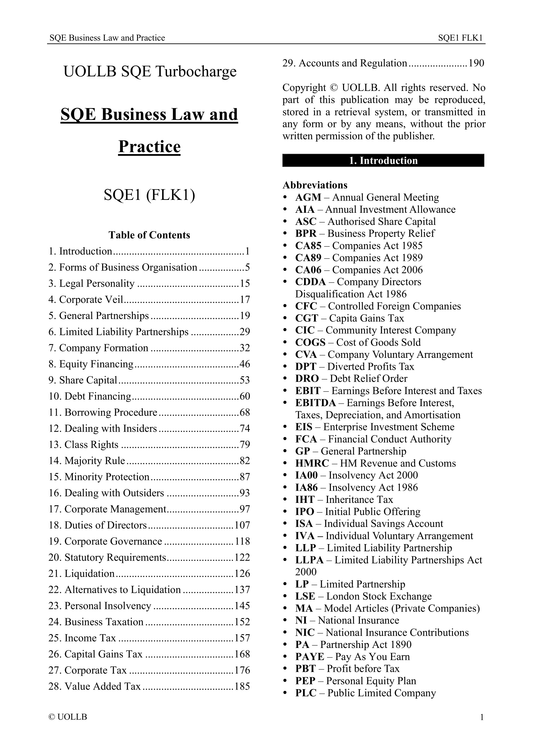

FLK1 covers the following areas: Business Law and Practice, Dispute Resolution, Contract, Tort, the Legal System of England and Wales, Constitutional and Administrative Law, EU Law, and Legal Services. FLK2 examines Property Practice, Wills and the Administration of Estates, Solicitors Accounts, Land Law, Trusts, and Criminal Law and Practice.

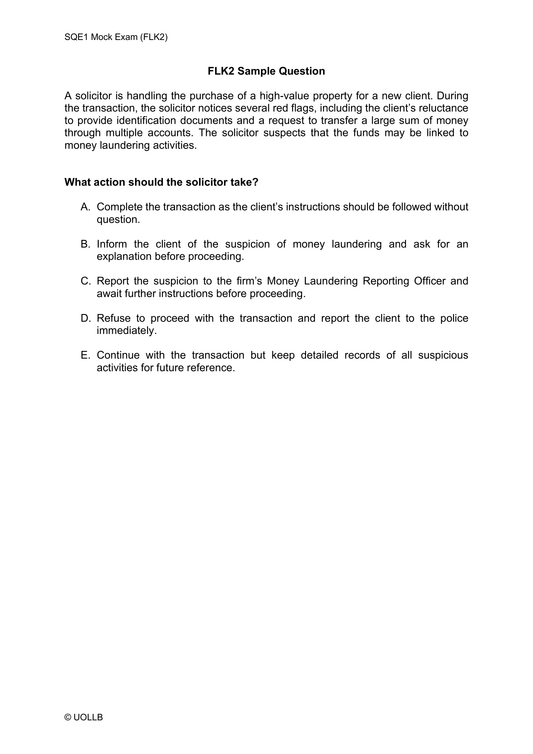

Ethics and Professional Conduct are a central component of both FLK1 and FLK2, requiring that you demonstrate comprehensive understanding of the ethical principles governing legal practice. These topics are not examined in isolation but are integrated throughout the exam questions to assess your ability to apply ethical principles in real-world scenarios.

Additionally, the principles of taxation are tested within specific contexts. Taxation will only be assessed in relation to Business Law and Practice, Property Law and Practice, and Wills and the Administration of Estates. You are tested on taxation where it is most relevant to legal practice.

The subject areas for each of the two FLK assessments are grouped into detailed sections, with assessment objectives clearly outlined. For each subject area, you are expected to apply their knowledge of the law and legal practice to answer the questions effectively. The assessments require you to demonstrate not only theoretical knowledge but also the ability to apply that knowledge in legal contexts.

FLK1 covers the following areas: Business Law and Practice, Dispute Resolution, Contract, Tort, the Legal System of England and Wales, Constitutional and Administrative Law, EU Law, and Legal Services. FLK2 examines Property Practice, Wills and the Administration of Estates, Solicitors Accounts, Land Law, Trusts, and Criminal Law and Practice.

Ethics and Professional Conduct are a central component of both FLK1 and FLK2, requiring that you demonstrate comprehensive understanding of the ethical principles governing legal practice. These topics are not examined in isolation but are integrated throughout the exam questions to assess your ability to apply ethical principles in real-world scenarios.

Additionally, the principles of taxation are tested within specific contexts. Taxation will only be assessed in relation to Business Law and Practice, Property Law and Practice, and Wills and the Administration of Estates. You are tested on taxation where it is most relevant to legal practice.

The subject areas for each of the two FLK assessments are grouped into detailed sections, with assessment objectives clearly outlined. For each subject area, you are expected to apply their knowledge of the law and legal practice to answer the questions effectively. The assessments require you to demonstrate not only theoretical knowledge but also the ability to apply that knowledge in legal contexts.