SQE Glossary

Share

The following terms and abbreviations are frequently found in the SQE curriculum, assessments, and study materials. We recommend that you familiarise yourself with all of them.

ABS (Alternative Business Structure)

An ABS is a law firm that has non-lawyers in managerial or ownership roles, allowing multidisciplinary practices that combine legal services with other professional services, such as financial or accounting advice. Introduced under the Legal Services Act 2007, ABSs aim to increase competition and innovation within the legal services market, making it more accessible and client-focused.

ADR (Alternative Dispute Resolution)

ADR refers to methods of resolving disputes outside of traditional court proceedings, such as mediation, arbitration, and negotiation. It is often faster, less expensive, and more flexible than litigation, encouraging parties to reach mutually acceptable solutions.

Affidavit

An affidavit is a formal, written statement of facts, voluntarily made by an individual, which is sworn (under oath) or affirmed to be true. It is signed by the person making the statement (known as the deponent or affiant) in the presence of a person legally authorised to administer oaths, such as a solicitor, notary public, or commissioner for oaths.

AML (Anti-Money Laundering)

AML refers to the laws, regulations, and procedures that financial and legal institutions must follow to detect and prevent money laundering activities. Law firms are required to implement AML measures, including conducting client due diligence, reporting suspicious activities, and training employees to comply with relevant AML regulations. This is essential to prevent the use of legal services for concealing illicit funds.

CGT (Capital Gains Tax)

CGT is a tax on the profit made when selling or disposing of an asset that has increased in value, such as property, shares, or business assets. The tax is calculated on the gain, not the total proceeds.

Client Account

A client account is a dedicated bank account that law firms use to hold client funds separate from the firm’s operational accounts. This ensures client money is protected and not used for the firm’s own expenses, as required by the SRA Accounts Rules. Client accounts are integral to maintaining trust and ethical handling of client funds.

Client Money

Client money includes all funds received by a law firm on behalf of a client, such as fees paid in advance, disbursements, or funds held for property transactions. The SRA Accounts Rules mandate that client money be held securely and separately from the firm’s own funds to prevent misappropriation and ensure transparency.

Conflict of Interest

A conflict of interest occurs when a law firm’s duties to one client conflict with its duties to another client or its own interests, potentially compromising impartiality. Identifying and managing conflicts is crucial to maintaining ethical standards and client trust, as conflicts can affect the firm’s ability to provide unbiased and effective representation.

COFA (Compliance Officer for Finance and Administration)

The COFA is a designated officer responsible for ensuring that a law firm complies with financial regulations, especially those related to handling client money under the SRA Accounts Rules. The COFA monitors financial transactions, addresses financial risks, and reports any significant breaches to the SRA to maintain accountability.

COLP (Compliance Officer for Legal Practice)

The COLP is a designated officer within a law firm responsible for overseeing regulatory compliance, ensuring that the firm adheres to SRA standards. The COLP must identify and report regulatory breaches and work to maintain the firm’s adherence to ethical, professional, and legal standards in its practice.

CPR (Civil Procedure Rules)

CPR govern the conduct of civil litigation in England and Wales, setting out the framework for case management in the courts. Their primary aim is to ensure that cases are dealt with justly and proportionately, promoting efficiency and fairness in resolving disputes.

CrimPD (Criminal Practice Directions)

CrimPD govern the conduct of criminal cases in England and Wales, ensuring that cases are handled justly, efficiently, and fairly. They set out the framework for criminal proceedings, covering case management, evidence disclosure, trial preparation, and appeals.

CrimPR (Criminal Procedure Rules)

CrimPR supplements the Criminal Procedure Rules by providing additional guidance on their application. They offer detailed instructions on specific procedural aspects, such as case management, vulnerable witnesses, sentencing, and professional conduct in court.

CVA (Company Voluntary Arrangement)

A CVA is a formal insolvency procedure allowing a company in financial difficulty to reach an agreement with its creditors to repay a portion of its debts over time while continuing to trade. It requires approval by at least 75% of creditors by value.

ECHR (European Convention on Human Rights)

The ECHR is an international treaty protecting fundamental human rights and freedoms in Europe, overseen by the Council of Europe and enforced by the ECtHR. In the UK, the Human Rights Act 1998 (HRA) incorporates most of the ECHR rights into domestic law, allowing individuals to bring claims in UK courts for alleged violations of their Convention rights.

ECtHR (European Court of Human Rights)

The ECtHR is an international court based in Strasbourg that enforces the ECHR. It ensures that Member States uphold their obligations under the ECHR. Individuals who believe their rights have been violated can take a case to the ECtHR if they have exhausted all domestic legal remedies.

FCA (Financial Conduct Authority)

The FCA is a UK regulatory body responsible for overseeing financial markets and firms, including those offering certain financial services within legal practices. The FCA’s mandate is to ensure consumer protection, promote fair competition, and maintain financial market integrity in the UK.

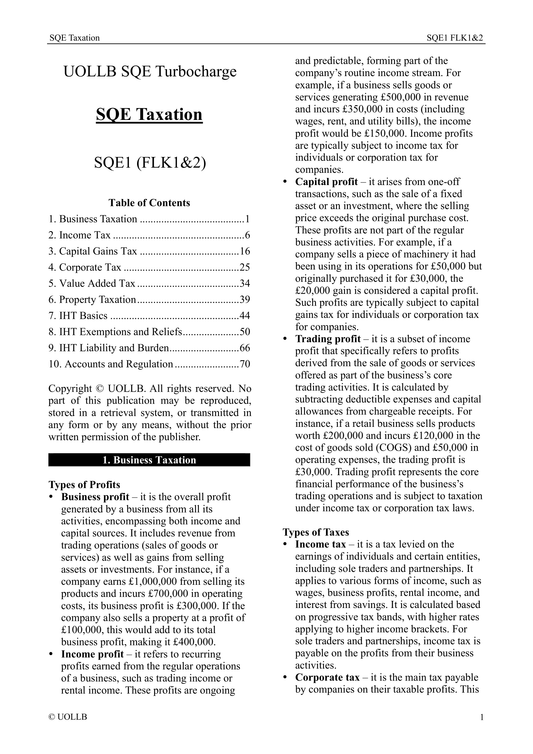

FLK (Functioning Legal Knowledge)

FLK refers to the core legal knowledge and understanding required for SQE1, covering key areas such as contract, tort, criminal, and property law. FLK assesses your ability to apply legal principles in practical scenarios, focusing on the functioning knowledge essential for everyday legal practice as a solicitor.

FLK1 (Functioning Legal Knowledge 1)

FLK1 is the first section of the SQE1 assessment, covering key areas of Functioning Legal Knowledge related to core practice areas such as business law and practice, dispute resolution, contract, tort, legal system, and constitutional law. FLK1 requires you to demonstrate foundational knowledge and application of these subjects through a multiple-choice format, testing your readiness for practical legal practice.

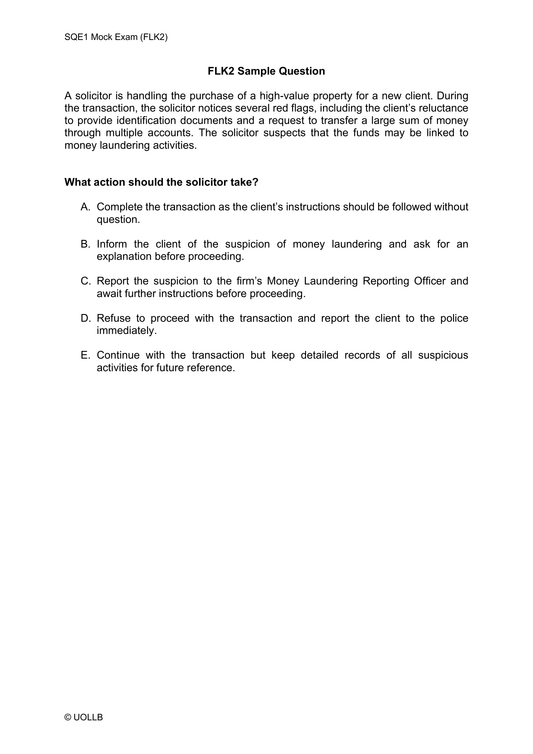

FLK2 (Functioning Legal Knowledge 2)

FLK2 is the second section of the SQE1 assessment, focusing on other essential areas of Functioning Legal Knowledge, including criminal law and practice, property practice, wills and administration of estates, and trust law. FLK2 assesses your understanding and practical application of these topics, ensuring comprehensive readiness across the SQE1 syllabus.

FSMA (Financial Services and Markets Act 2000)

The FSMA governs the regulation of financial markets and services in the UK, giving regulatory powers to the FCA and PRA. FSMA sets standards for financial activities, impacting some law firms that provide financial advice or services, ensuring compliance with regulations designed to protect consumers and maintain market stability.

HOFA (Head of Finance and Administration)

The HOFA is typically responsible for managing a law firm’s financial and administrative operations. In smaller firms, the HOFA’s duties may overlap with those of the COFA, focusing on financial compliance, budgeting, and overall financial health to ensure regulatory adherence and business stability.

HOLP (Head of Legal Practice)

The HOLP is responsible for overseeing the quality and compliance of a firm’s legal services, ensuring adherence to professional standards. This role often involves working closely with the COLP to monitor legal practice operations, uphold ethical standards, and meet the regulatory requirements set by the SRA.

HRA (Human Rights Act 1998)

The HRA incorporates most of the rights contained in the European Convention on Human Rights into UK law, enabling individuals to seek redress for violations in UK courts. Before the HRA, if a person in the UK believed his human rights (as guaranteed by the ECHR) had been violated, he would often have to take his case to the ECtHR in Strasbourg, a process that was lengthy and expensive.

IHT (Inheritance Tax)

IHT is a tax on the estate (property, money, and possessions) of a person who has died. In the UK, it is charged at 40% on the value of the estate above the nil-rate band threshold, subject to exemptions and reliefs.

IVA (Individual Voluntary Arrangement)

An IVA is a legal agreement between an individual and his creditors to pay off debts over a fixed period, typically five years, often as an alternative to bankruptcy. It is managed by an insolvency practitioner.

Jervis v Harris Clause

A Jervis v Harris clause allows a landlord to recover costs for repairing tenant breaches directly by re-entering the property and charging the tenant as a debt, avoiding forfeiture proceedings.

NCA (National Crime Agency)

The National Crime Agency (NCA) is a UK law enforcement body focused on tackling serious and organised crime, including financial crime and money laundering. Law firms report suspicious financial activities related to money laundering to the NCA, often through their MLRO, to support national crime prevention efforts.

PACE (Police and Criminal Evidence Act 1984)

The PACE established a framework for police powers in areas such as arrest, stop and search, and the detention and questioning of suspects. It aims to balance the need for effective policing with the protection of individual rights, providing detailed Codes of Practice that police officers must follow to ensure fairness and accountability.

Part 8 Claim

A Part 8 claim is a legal procedure under the Civil Procedure Rules that allows a claimant to ask the court to decide a question that is unlikely to involve a significant factual dispute. Part 8 claims are a simpler and faster alternative to the more common Part 7 procedure.

Part 20 Claim

A Part 20 Claim refers to any claim made in proceedings other than the main claim brought by the original claimant against the original defendant. Typically, it is a claim brought by a defendant or third party for contribution, indemnity, or any other related claim within the same proceedings under the Civil Procedure Rules.

Part 36 Offer

A Part 36 Offer is a settlement offer made under the Civil Procedure Rules that encourages parties to resolve disputes early and out of court. This is achieved by imposing significant adverse financial consequences on the party who unreasonably refuses a genuine offer made by the opposing side to settle the dispute.

PD (Practice Direction)

A Practice Direction (PD) is a set of rules and guidelines issued by the courts to supplement and explain the Civil Procedure Rules (CPR), Criminal Procedure Rules (CrimPR), or Family Procedure Rules. They provide practical guidance on how the courts expect legal practitioners and litigants to conduct themselves in various stages of legal proceedings. In our study manuals, a PD refers to supplementary guidance accompanying the CPR only and offers practical details on how specific rules should be applied in civil proceedings.

PRA (Prudential Regulation Authority)

The PRA, part of the Bank of England, oversees the financial stability of institutions like banks and insurers. While the PRA does not regulate law firms directly, its regulations impact financial services within firms that may engage in certain regulated activities, especially those related to financial advice.

LSA (Legal Services Act 2007)

The LSA introduced major reforms in the legal services sector, including the regulation of alternative business structures (ABS) and the establishment of the Legal Services Board. The LSA emphasises consumer protection, promoting competition, and improving access to justice within the legal industry.

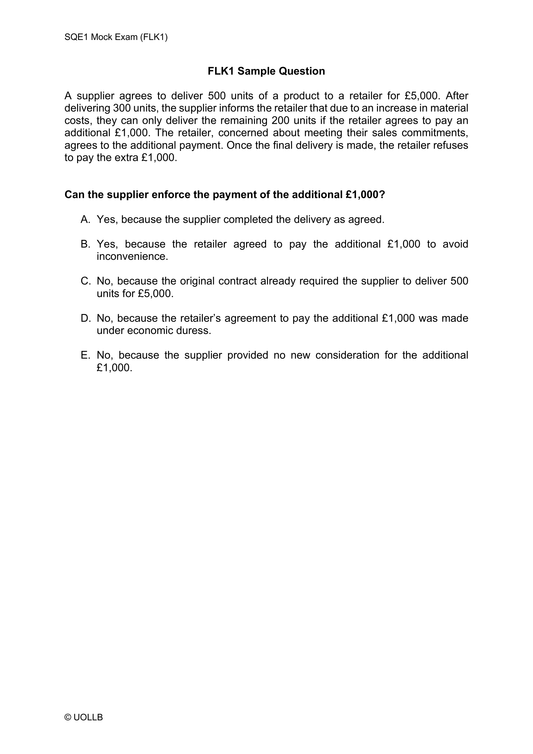

MCQ (Multiple Choice Question)

MCQ is a type of assessment where a question or statement is presented along with a list of several possible answers, only one of which is correct. SQE1 candidates must select the single best answer from the 5 options provided, making it an effective method for evaluating knowledge and understanding across various legal subjects.

MLCO (Money Laundering Compliance Officer)

The MLCO oversees compliance with anti-money laundering (AML) regulations within a law firm, implementing policies, managing risk assessments, and ensuring staff training. This officer plays a crucial role in detecting and preventing money laundering activities, meeting the firm’s legal obligations to combat financial crime.

MLRO (Money Laundering Reporting Officer)

The MLRO is the designated person within a firm who receives and assesses internal reports of suspicious financial activities. If necessary, the MLRO escalates these reports to the NCA, serving as the firm’s liaison for anti-money laundering compliance and reporting obligations.

MTC (Minimum Terms and Conditions)

The Minimum Terms and Conditions (MTC) are mandatory requirements for professional indemnity insurance policies held by law firms. These terms ensure clients have sufficient protection if claims are brought against the firm for errors, negligence, or misconduct, as specified by the SRA.

NQ (Newly Qualified)

NQ refers to a solicitor who has just completed his training contract or QWE under the SQE route and has been formally admitted to the roll of solicitors. NQ solicitors typically begin working as junior associates in law firms, often specialising in the area they trained in.

PQE (Post-Qualified Experience)

PQE refers to the number of years a lawyer has worked in a legal role after becoming fully qualified in his jurisdiction. It is a common metric used by law firms and recruiters to gauge a lawyer's level of experience and often influences salary and seniority.

QWE (Qualifying Work Experience)

QWE is a flexible, hands-on training requirement under the SQE route, where you complete two years of practical legal experience in up to four different legal settings. It allows you to gain relevant skills and knowledge before, during, or after your SQE exams, provided the experience is signed off by a solicitor or authorised supervisor.

REL (Registered European Lawyer)

An REL is a lawyer from a European Economic Area (EEA) country registered under the SRA Register of European Lawyers to practise in England and Wales. RELs must comply with SRA regulations and are permitted to perform certain legal activities in England and Wales, with pathways available for eventual qualification as solicitors.

RFL (Registered Foreign Lawyer)

An RFL is a lawyer from a jurisdiction outside the EEA who is registered under the SRA Register of Foreign Lawyers to practise in England and Wales. RFLs are subject to SRA regulations and may provide limited legal services in specific areas, though they may need additional qualifications to expand their practice scope.

RSL (Registered Swiss Lawyer)

An RSL is a lawyer from Switzerland who is registered under the SRA Register of Swiss Lawyers to practise in England and Wales. Like RELs and RFLs, RSLs are subject to SRA regulations and may provide legal services in accordance with the Recognition of Professional Qualifications and Implementation of International Recognition Agreements (Amendment) (Extension to Switzerland etc.) Regulations 2024, with pathways available for eventual qualification as solicitors.

Rylands v Fletcher

Rylands v Fletcher [1868] is a key tort case establishing a principle of strict liability for damage caused by the escape of a dangerous thing from one’s land. If a person brings onto his land something likely to cause mischief if it escapes, and that thing is accumulated for a non-natural use of the land, he is liable for any foreseeable damage caused by its escape, even if he was not negligent.

Saunders v Vautier

Saunders v Vautier [1841] is a landmark English trusts law that established the rule that beneficiaries of a trust can terminate the trust and receive the legal estate if all beneficiaries are of adult age and have no disability, all beneficiaries are entitled to the trust property, and the beneficiaries agree to end the trust.

SCS (Standard Conditions of Sale)

The SCS is a set of model terms used in residential property transactions in England and Wales to ensure consistency and fairness between buyers and sellers for the sale and purchase of houses, flats, and other residential properties. It is widely used in conveyancing and are often implicitly or explicitly incorporated into contracts drafted by solicitors.

SCPC (Standard Commercial Property Conditions)

The SCPC is standard terms used in commercial property transactions, covering matters such as title, risk, and completion, designed to streamline the process. It is designed for the sale and purchase of commercial properties such as offices, shops, industrial units, and development land. These transactions are typically more complex than residential ones and require specific provisions.

Senedd Cymru

Senedd Cymru, also known as the Welsh Parliament, is the devolved, unicameral, and democratically elected legislature for Wales. Located in Cardiff, it is responsible for making laws on devolved matters such as health, education, and housing, and plays a crucial role in the governance of Wales.

SQE (Solicitors Qualifying Examination)

The SQE is a standardised assessment introduced as a new route to qualifying as a solicitor in England and Wales. It comprises SQE1, which tests legal knowledge (FLK), and SQE2, which assesses practical skills like client interviews and advocacy, ensuring consistent standards across the legal profession.

SQE1 (Solicitors Qualifying Examinations Stage 1)

SQE1 is the first part of the Solicitors Qualifying Examination (SQE), focusing on testing Functioning Legal Knowledge (FLK) across a broad range of practice areas such as contract, tort, criminal law, and property. SQE1 is assessed through multiple-choice questions where you must select the single best answer. This exam ensures that aspiring solicitors possess the foundational legal knowledge necessary to practice law effectively.

SQE2 (Solicitors Qualifying Examinations Stage 2)

SQE2 is the second part of the SQE, focusing on practical legal skills needed for solicitors to serve clients competently. SQE2 assesses skills such as client interviewing, advocacy, legal writing, and drafting through a series of simulations and written exercises. Passing SQE2 demonstrates that you can apply legal knowledge in practical, real-world scenarios and meet the professional standards required of solicitors.

SRA (Solicitors Regulation Authority)

The SRA is the regulatory body for solicitors in England and Wales, responsible for setting professional standards, enforcing ethical codes, and overseeing compliance within the legal profession. Its primary aim is to protect public interest by ensuring high standards in legal services.

SRA Accounts Rules

The SRA Accounts Rules govern the management of client money within law firms, mandating that it be held securely in a separate client account and kept distinct from the firm’s funds. These rules aim to protect clients and uphold trust by ensuring ethical financial practices.

SRA Code of Conduct for Firms

This Code of Conduct outlines the regulatory obligations of law firms, covering client care, risk management, and compliance requirements. It sets the ethical and professional standards that firms must follow to maintain trust and transparency in their legal services.

SRA Code of Conduct for Solicitors, RELs, RFLs and RSLs

This code sets out the standards of conduct expected of solicitors, Registered European Lawyers (RELs), Registered Foreign Lawyers (RFLs) and Registered Swiss Lawyers (RSLs), including integrity, professionalism, and client-focused service. It provides specific guidelines for handling conflicts, confidentiality, and ethical obligations.

SRA Financial Services (Conduct of Business) Rules

These rules define how law firms should manage financial services offered within legal practice, emphasising transparency, client protection, and ethical standards in financial dealings. Firms must adhere to these rules to ensure compliance with FSMA requirements and client safeguards.

SRA Financial Services (Scope) Rules

The Scope Rules outline the types of financial services that law firms can provide within the bounds of FSMA, ensuring firms operate within authorised limits. This rule restricts the financial services offered by law firms to those compliant with financial regulations and consumer protection laws.

SRA Indemnity Insurance Rules

The SRA Indemnity Insurance Rules require law firms to hold professional indemnity insurance that meets the Minimum Terms and Conditions (MTC). This insurance is essential for protecting clients in cases of negligence, errors, or breaches of duty by the firm in the provision of legal services.

SRA Principles

The SRA Principles are fundamental ethical standards that all solicitors and law firms must follow, including acting with integrity, upholding the rule of law, and maintaining client confidentiality. These principles underpin the SRA’s regulatory framework, guiding legal professionals in ethical decision-making.

SRA Transparency Rules

The Transparency Rules require law firms to provide clear, accessible information on their services, fees, and regulatory protections. This rule aims to help clients make informed choices and enhance openness within the legal profession by promoting a client-centred approach.

VAT (Value Added Tax)

VAT is a consumption tax charged on the supply of goods and services in the UK. Businesses add VAT to their prices, which is ultimately borne by the end consumer. The standard rate in the UK is 20%.

Volenti Non Fit Injuria

This legal doctrine means “to a willing person, no injury is done”. It is a defence in tort law, particularly in cases involving negligence or personal injury. If a person voluntarily consents to a risk of harm, he cannot later claim damages for any injury resulting from that risk.