SQE2 Overview

Share

The SQE2 assessment evaluates your practical legal skills across six core areas: client interview and attendance note or legal analysis, advocacy, case and matter analysis, legal research, legal writing, and legal drafting. Although negotiation is not a distinct assessment in SQE2, it is integrated into other tasks, such as client interviews, case and matter analysis, or legal writing. The assessment is divided into oral (two half days) and written (three half days) components. You will need to attend the test centre for a total of five half-days.

Practice Areas and Legal Foundations

In the SQE2 assessment, legal skills are tested through five key practice areas, each grounded in substantive legal principles. These areas provide you with the context to demonstrate your practical legal skills.

1. Criminal Litigation assesses your ability to advise and assist clients facing criminal charges. This includes attending police station interviews and understanding the rules around criminal procedure and evidence. The area draws on the principles of criminal liability, requiring a sound grasp of offences, defences, and procedural safeguards.

2. Dispute Resolution focuses on civil litigation and involves tasks such as advising clients on claims, drafting statements of case, and engaging with pre-action protocols. This practice area draws on fundamental legal doctrines from contract law and tort law, enabling you to resolve disputes through court procedures or alternative dispute resolution methods.

3. Property Practice requires you to apply land law in real-world conveyancing and lease transactions. This includes drafting, reviewing, and advising on documents related to buying, selling, or leasing property, as well as managing risks associated with title, registration, and planning issues.

4. Wills and Intestacy, Probate Administration, and Practice focuses on advising clients on succession planning and administering estates. This area draws heavily from trusts law, particularly in drafting wills, interpreting testamentary documents, and handling inheritance and tax issues during the probate process.

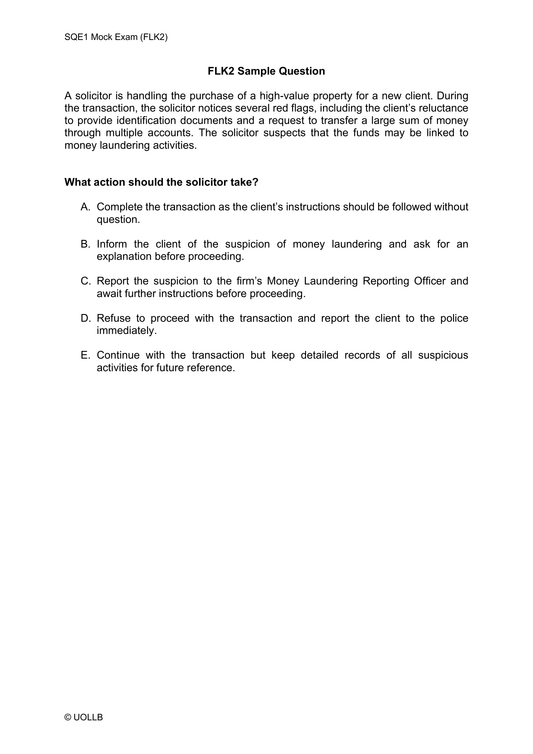

5. Business Organisations, Rules, and Procedures tests your understanding of company law, including forming and managing business entities. You are expected to advise on matters relating to contract law, company governance, shareholder rights, partnership issues, and regulatory compliance, including money laundering and financial services legislation.

Throughout all five practice areas, professionalism and ethics are assessed implicitly. You are expected to identify and respond to ethical dilemmas, such as conflicts of interest, confidentiality breaches, or dishonest conduct, without being prompted. Upholding the core values of integrity, honesty, and professional responsibility is essential, and failure to do so can affect your overall performance, regardless of your legal knowledge.

Taxation and Examinable Content

Taxation-related questions may appear in Property Practice, Wills and Intestacy, and Business Organisations. The examinable content in SQE2 is detailed in Annex 1, which serves as a subset of the Functioning Legal Knowledge (FLK) covered in SQE1. Topics such as the legal system of England and Wales, constitutional and administrative law, EU law, and solicitors accounts are not examined in SQE2, except for money laundering and financial services in the context of business organisations.

Cut-off Date for the Law Examined

You will be tested on the law as it stands four calendar months before the first assessment date in an assessment window. Any changes to the law implemented up to and including that date are examinable. This means you must be prepared to answer questions based on the law as it stands up to and including that specific cut-off date. However, developments in the law beyond that date will not be assessed.

SQE2 Oral Assessment

The oral assessments are conducted over two half days and test client interviewing, attendance note completion, and advocacy skills across four oral exams. Day 1 covers civil advocacy, dispute resolution, and property practice, while Day 2 focuses on criminal advocacy, criminal litigation, and wills, intestacy, and probate administration, with each including a client interview, attendance note, and legal analysis.

SQE2 Written Assessment

The written assessments span three half days and assess legal research, writing, drafting, and case and matter analysis across five areas of law. Day 1 tests dispute resolution and criminal litigation; Day 2 covers property practice and wills, intestacy, and probate administration; and Day 3 focuses on business organisations, rules, and procedures.

The SQE2 assessment is designed to test practical legal skills and their application within fundamental legal principles across core practice areas. It incorporates ethics and professionalism as pervasive elements and emphasises current, well-defined legal knowledge to prepare you for the realities of practice as a newly qualified solicitor.