SQE1 Curriculum Explained

Share

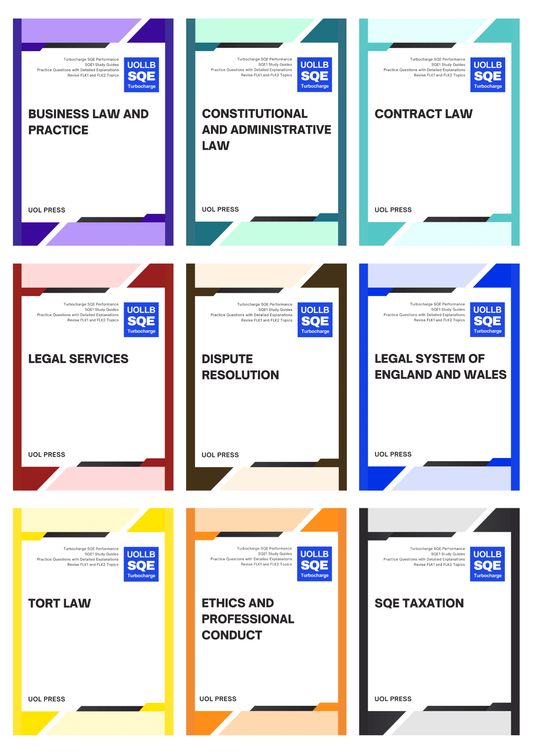

If you are preparing for the SQE, you may have no idea why the SQE Assessment Specification is organised in its current form. In fact, the SQE1 Curriculum comprises seven foundations subjects, five practical subjects and four SRA subjects.

7 Foundation Subjects

The seven foundation subjects are Constitutional and Administrative Law (Public Law), Contract Law, Criminal Law, Land Law, Legal System of England and Wales, Tort Law and Trusts Law. Most UK law graduates should have studied these foundation subjects in their LLB programme. However, some topics, such as Public Order Law and the Equality Act 2010, may not be covered by ordinary LLB programmes. Nevertheless, if you are a law student, you should select these subjects for your law degree to maximise your chances of success.

5 Practical Subjects

The five practical subjects are Business Law and Practice, Criminal Practice, Dispute Resolution, Property Practice, and Wills and the Administration of Estates. These subject are traditionally the content-heavy LPC subjects most LLB graduates may not have studied. However, certain LLB elective modules, such as Company Law, Land Law, Evidence Law, and Succession Law, may cover certain topics within the practice subjects. You are therefore advised to choose those modules which will give you an unparalleled advantage.

4 SRA Subjects

The four SRA subjects include Ethics and Professional Conduct, Legal Services, Solicitors Accounts, and Taxation, are specifically covered in your SQE curriculum. These subjects are regulatory subjects, and most law students may not have studied them. Thankfully, they are not difficult subjects, so you should be able to handle them with ease, except Taxation if you are not good with numbers. All taxation topics come from Business Law and Practice, Property Practice, and Wills and the Administration of Estates.

If you are really hopeless in taxation or you do not have enough time, you may skip it and still pass the SQE. However, we do not recommend skipping any subjects, particularly taxation, because taxations topics are relatively easy and straightforward, involving only simple calculation and accounting concepts.