Can You Skip All Taxation Topics and Still Pass SQE1?

Share

For many aspiring solicitors, the thought of tackling taxation topics in the SQE1 exams can feel overwhelming. If you are one of those who feel hopeless about taxation, it is not the end of the world. Take a look at our analysis below.

Taxation in FLK1

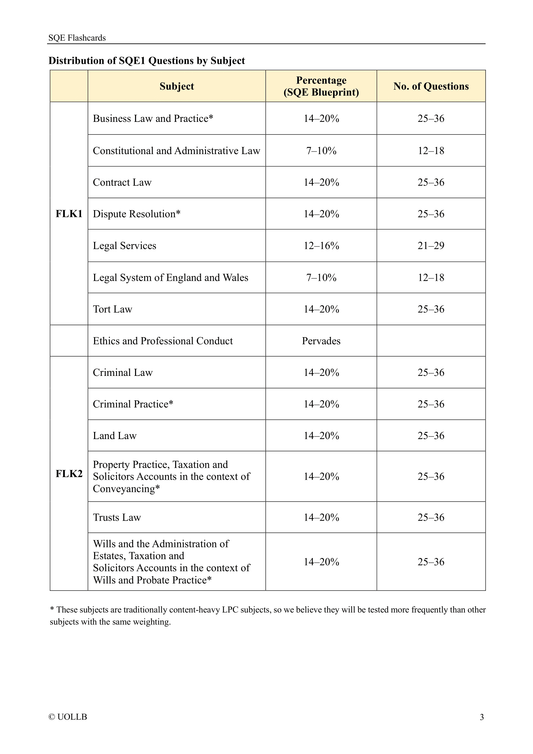

According to the SQE Blueprint (FLK1), there are 25–36 questions (14–20%) on Business Law and Practice, which covers four taxation topics:

- Income Tax (1–2 questions expected)

- Corporation Tax (1–2 questions expected)

- Capital Gains Tax (1–2 questions expected)

- Value Added Tax (1–2 questions expected)

In total, we estimate that there will be 5–7 questions on taxation in FLK1. According to past statistics, you need to answer 99–103 questions correctly out of 180 to pass FLK1. This means that even if you skip all the taxation questions, you can still pass FLK1 without any difficulty.

Taxation in FLK2

According to the SQE Blueprint (FLK2), there are 25–36 questions (14–20%) on Property Practice, which includes three taxation topics:

- Stamp Duty Land Tax (1–2 questions expected)

- Capital Gains Tax (1–2 questions expected)

- Value Added Tax (1–2 questions expected)

According to the SQE Blueprint (FLK2), there are 25–36 questions (14–20%) on Wills and the Administration of Estates, which includes one taxation topic:

- Inheritance Tax (1–2 questions expected)

Combined, we estimate there will be 6–8 taxation questions in FLK2. Similar to FLK1, you need to answer 99–103 questions correctly out of 180 to pass FLK2. This means you can skip all taxation topics and still pass FLK2 without any difficulty.

Although it is possible to give up on all taxation topics and pass both FLK1 and FLK2, mastering these areas can significantly boost your chances of success. Taxation questions are often straightforward, so a strong understanding of these topics could provide you with relatively easy marks.

The SQE1 exams are challenging, but strategic preparation can make a difference. If taxation feels like an insurmountable hurdle, you can skip these topics and still have a solid chance of passing both FLK1 and FLK2. However, investing time to master taxation topics can be a game-changer, so we have prepared our highly-acclaimed SQE Taxation Study Guide to help you overcome this hurdle.