How to Apply Legal Principles and Rules in SQE1?

Share

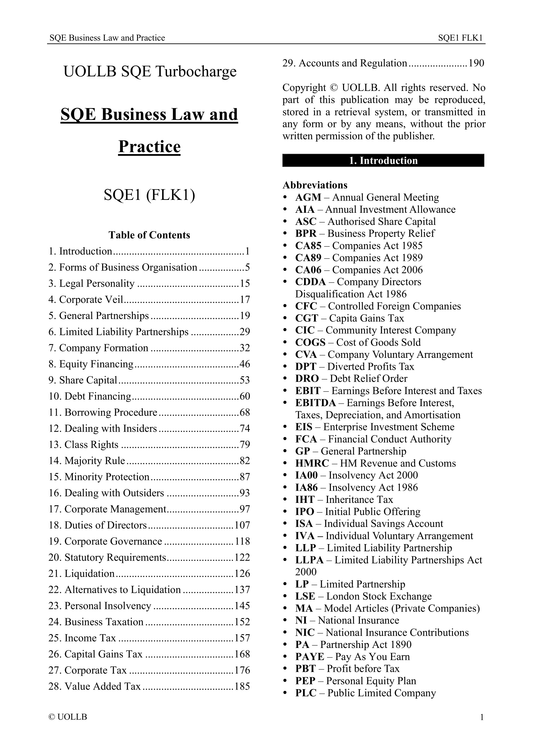

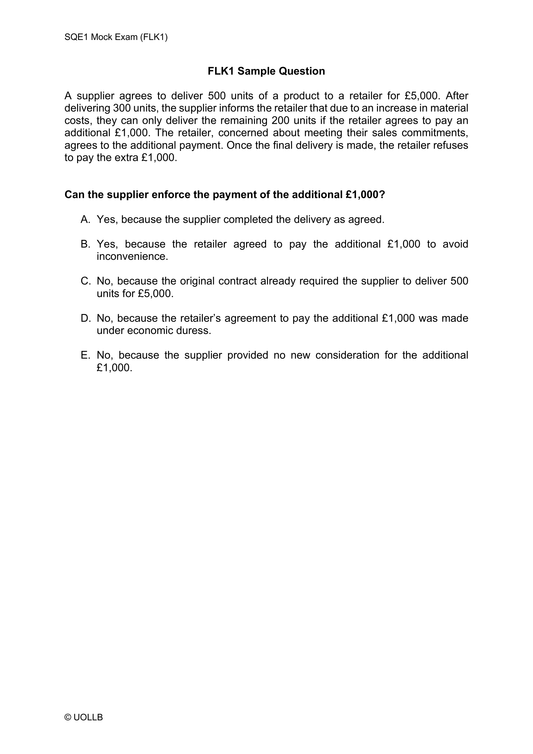

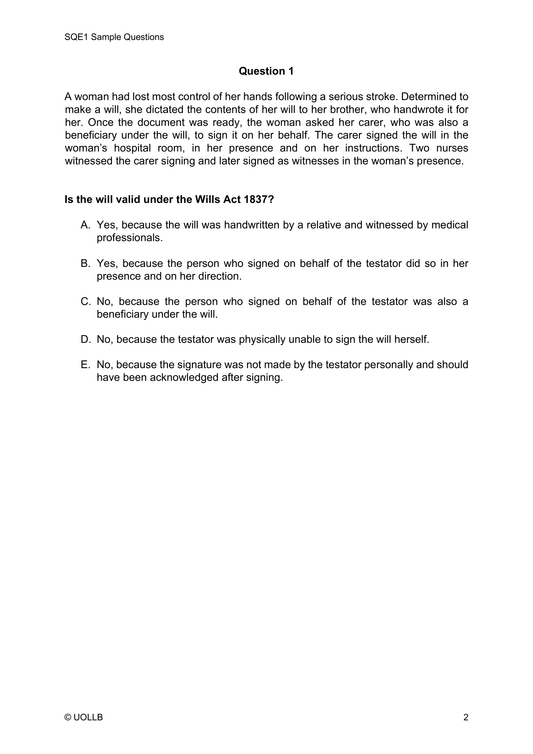

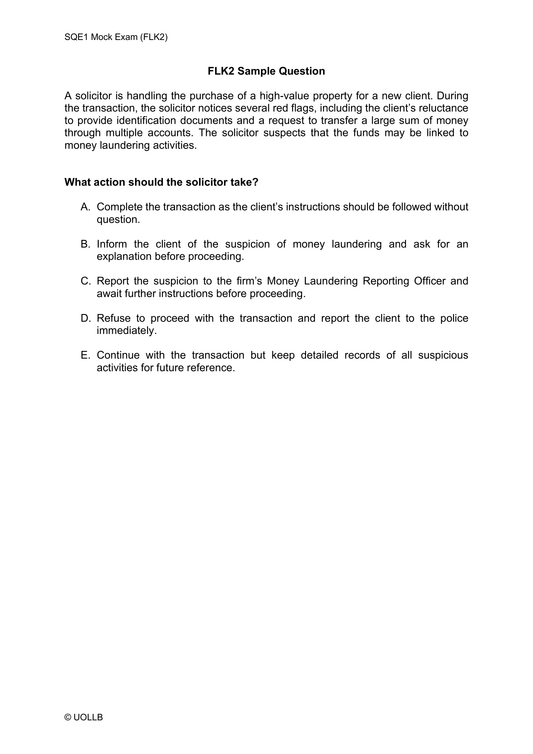

The application of legal principles and rules in the SQE1 Functioning Legal Knowledge (FLK) assessments is tested through a variety of question styles designed to evaluate both knowledge and practical understanding. These questions may require you to identify and apply a fundamental legal principle or rule to a given scenario. This tests your ability to solve legal problems similar to those encountered by newly qualified solicitors. In some cases, the legal principle may be provided within the question, and you must demonstrate the correct application of that principle to determine an appropriate legal outcome.

For example, you might be asked to determine whether a client can achieve a desired legal outcome, requiring you to offer clear and accurate advice based on your understanding of the law. Alternatively, the question may present an established legal result, and you would need to explain which legal rule or principle produced that result and why. This tests not only your knowledge of the law but also your ability to apply that knowledge logically and coherently.

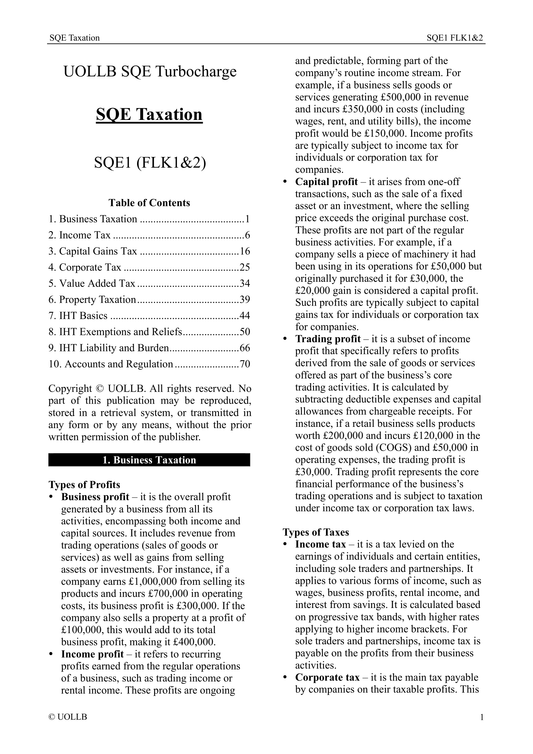

Some questions may require you to perform specific calculations, such as applying rules, rates, percentages, and thresholds to arrive at a correct figure. For questions related to taxation, you are expected to remember long-standing rates and thresholds, as well as understand the availability of certain tax reliefs and exemptions. However, when tax rates and thresholds change frequently due to new Budgets, the necessary figures for such calculations would typically be provided within the question itself.

Published sample questions serve as valuable tools, offering insight into the types of questions you may encounter in the assessments. These examples help you understand how you will be expected to apply the fundamental legal principles and rules that are laid out in the assessment specification.

For example, you might be asked to determine whether a client can achieve a desired legal outcome, requiring you to offer clear and accurate advice based on your understanding of the law. Alternatively, the question may present an established legal result, and you would need to explain which legal rule or principle produced that result and why. This tests not only your knowledge of the law but also your ability to apply that knowledge logically and coherently.

Some questions may require you to perform specific calculations, such as applying rules, rates, percentages, and thresholds to arrive at a correct figure. For questions related to taxation, you are expected to remember long-standing rates and thresholds, as well as understand the availability of certain tax reliefs and exemptions. However, when tax rates and thresholds change frequently due to new Budgets, the necessary figures for such calculations would typically be provided within the question itself.

Published sample questions serve as valuable tools, offering insight into the types of questions you may encounter in the assessments. These examples help you understand how you will be expected to apply the fundamental legal principles and rules that are laid out in the assessment specification.